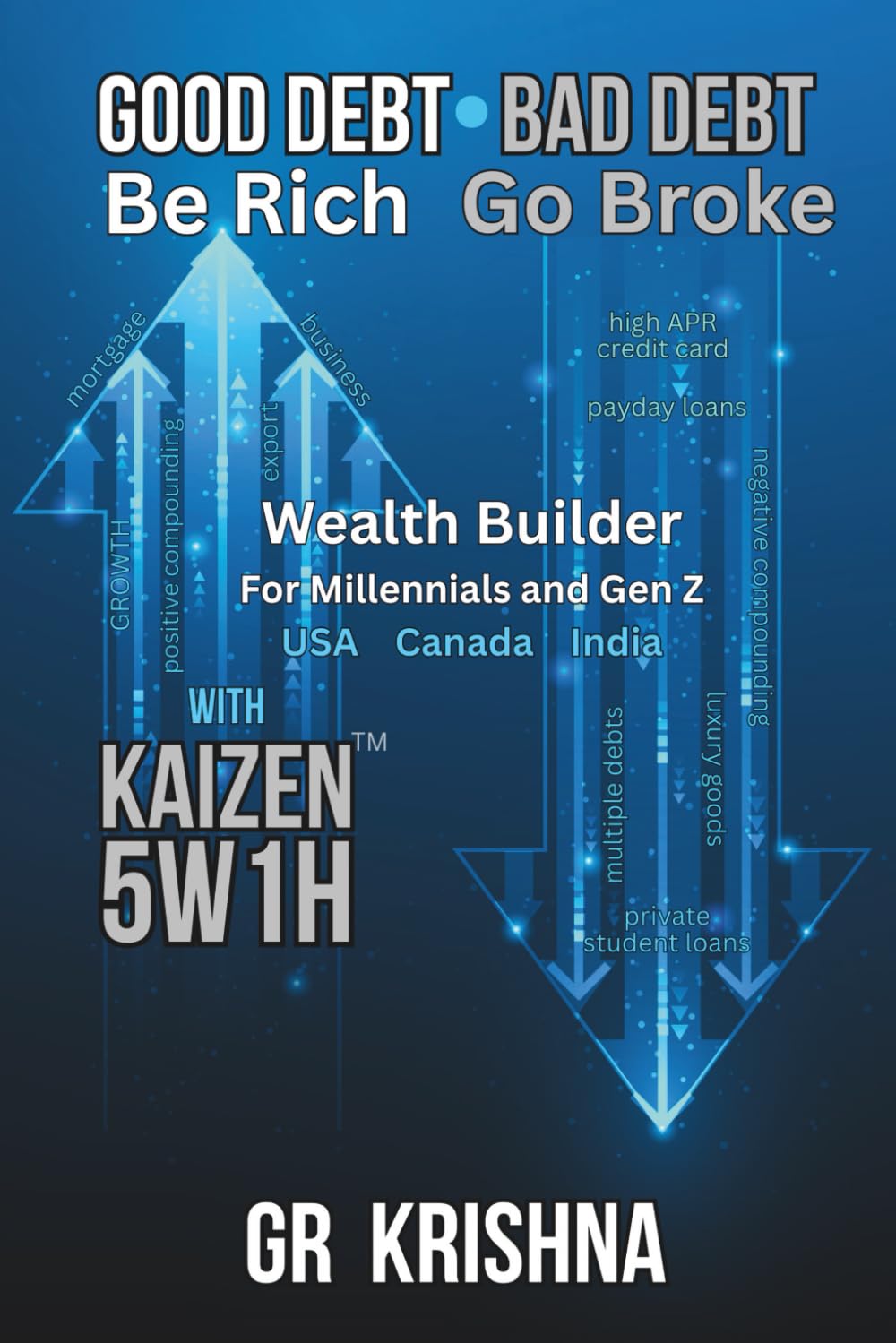

Good Debt Bad Debt - Be Rich or Go Broke Are you ready to break free from the cycle of bad debt, value good debt, and build real wealth? Millennials and Gen Z in India, Canada, and the USA earn more than ever, yet face rising debt, unclear net worth, and a confusing financial landscape. The answer? Work harder if you choose to; however, start asking smarter questions. “The best time to plant a tree was twenty years ago. The second best time is now.” This book offers a proven framework: The 5W1H method- What, Who, Where, When, Why, How—to clarify your financial challenges and goals. The power of KAIZEN : small, consistent small steps to create lasting wealth, not quick fixes. Key ideas: ✓ Differentiating good debt (which appreciates and builds assets) from bad debt (which depreciates and drains future resources). ✓ A step-by-step guide to eliminating bad debt and leveraging good debt for lifelong growth. ✓ Adapting the world’s best problem-solving architecture to personal finance—finally, strategy replaces stress. Features and benefits: Direct solutions tailored to Millennials in India: family expectations, real estate, blending tradition with aspirations. - Customized advice for Gen Z in India, Canada, and the US: student loans, rental pressures, side hustles, and digital finance traps. - Frameworks adaptable to all situations—urban or rural, employed or entrepreneurs, single or supporting families. By reading this book, you will: ✓ Identify every debt—know what to eliminate, leverage, and how to act. ✓ Turn financial worries into clear, actionable questions to find answers. ✓ Start a KAIZEN habit—making financial freedom measurable and tangible. ✓ Craft a debt-elimination plan suited to your income and life stage. ✓ Understand the psychology behind money behaviors—why we spend, fear, or self-sabotage. ✓ Learn to use good debt for investments in property, education, or business. ✓ Create effective action plans regardless of your starting salary. What this book does NOT include: Hype, or cryptocurrency speculation - Shame-based budgeting, deprivation culture, or generic advice - Confusing jargon, or false promises of quick wealth. What you will find: ✓ A trusted framework adapted for your financial journey. ✓ Honest, practical insights about debt, behavior change, and wealth psychology. ✓ Real stories and worksheets for immediate use. ✓ A practical, accountable, compassionate, and responsible approach. This book is for: ✓ Millennials and Gen Z in India, Canada, and the USA ✓ Anyone exhausted by countless finance books ✓ Those ready to build wealth within today's systems and realities. Financial freedom means having choices. It‘s peace of mind, flexibility, and living aligned with your values—not just accumulating wealth. With the right questions and small daily steps, your path to freedom can start today. "Money is merely the servant of what truly enriches: the bonds we forge, the possibilities we dare imagine, and the purposeful lives we construct. It is fuel for being, not the fire itself."