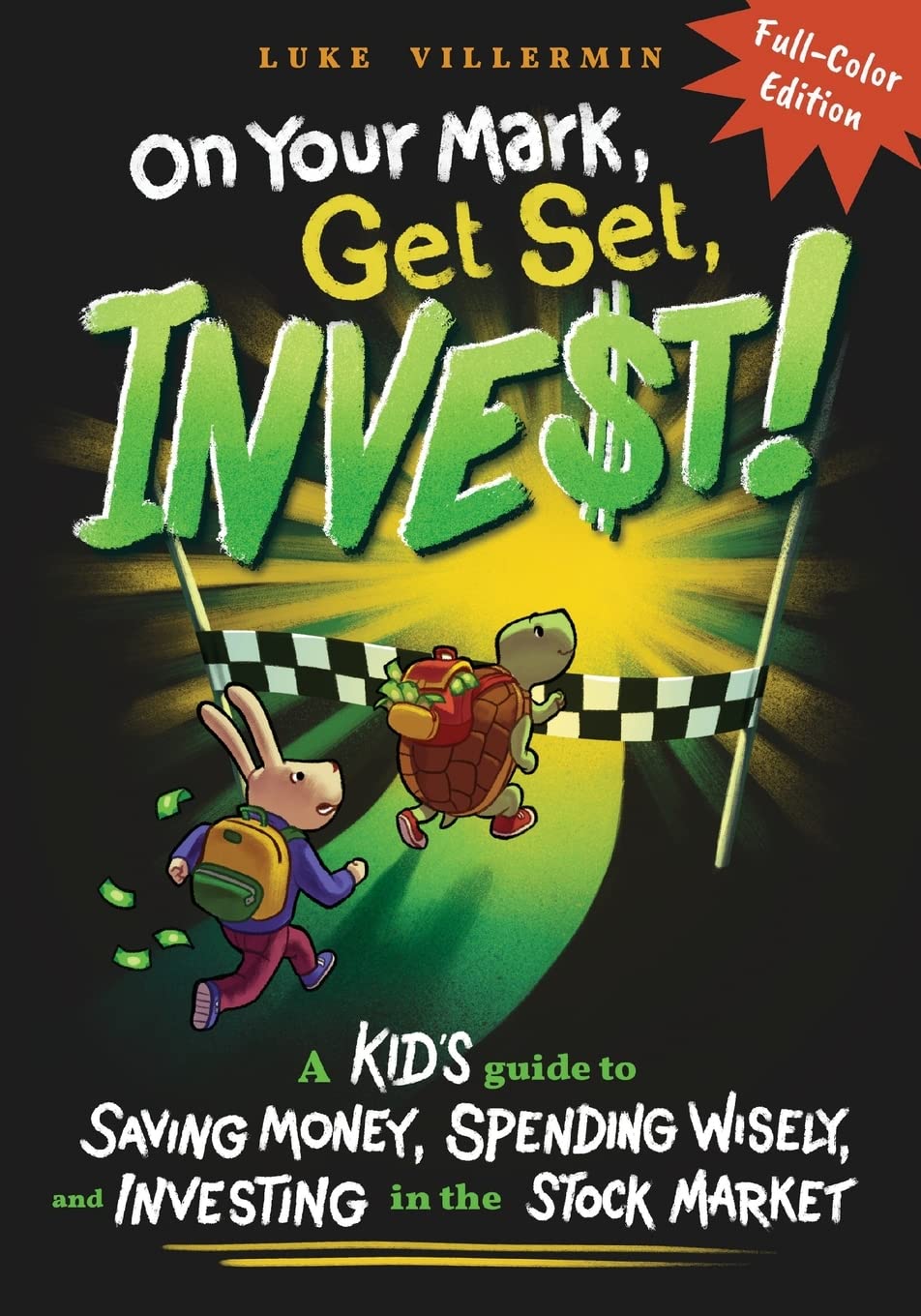

On Your Mark, Get Set, INVEST: A Kid's Guide to Saving Money, Spending Wisely, and Investing in the Stock Market (Full-Color Edition) (Invest Now Play

$15.99

by Luke Villermin

Shop Now

(Full-Color Edition) Slow and steady wins the race―an intro to personal finance and investing for kids ages 8 to 12 Feet thumping and arms swinging, Thrifty Tortoise and Ritzy Rabbit set off on a race to the finish line. At the end awaits a brand-new bike! Follow this competition to see who can earn, save, and invest their way to the ultimate prize. Lots of money decisions will be made along the way—some good and some bad—but you’ll get to learn from them all! Geared for kids ages 8 to 12, On Your Mark, Get Set, INVEST provides seven engaging chapters to simplify the essential concepts of personal finance and money management…many of which are not taught in schools. You will find answers to questions like: Where does money come from, what do I need it for, and where do I store it? - Why will I be better off later if I spend less and save more now ? - How does creating a budget help me reach my money goals? - What is the stock market, and how is compounding a kid’s most awesome superpower? With over a dozen interactive worksheets, fun illustrations, and kid-friendly examples, this book will get you closer to the finish line with every turn of the page. "If you're a parent or teacher looking to teach kids lessons that aren't always addressed in the classroom, look no further than Luke Villermin's new children's book, which teaches young readers valuable lessons about earning, saving, and investing money...using kid-friendly examples, hands-on activities, and vocabulary lessons." —Felicia Bengtsson, editorial manager at Reedsy Discovery Dear Parents, Guardians, and Mentors, How many times in your adult life have you been left bamboozled after browsing through a bank statement, when trying to get your credit score higher, or while setting up a retirement account through your new employer? Some of the smartest people in the world, even those with high-paying jobs, are bogged down by debt, struggle to make ends meet, and have little to show in their bank accounts. Why? The likely cause is a lack of money management skills...skills that are unfortunately not taught in most education systems. According to research by Brown University and the University of Cambridge, our money habits are ingrained in us by as early as age 9. And researchers found that once those money habits are formed, it's very difficult to reverse them later in life. Things like budgeting, planning ahead, delayed gratification, and returning borrowed items are behaviors that we develop (or don't develop) in childhood and then carry into our adult lives. I wrote On Your Mark, Get Set, INVEST as a teaching aid to help you walk through money conversations with your children. As you will see, a large portion of the content within is meant to establish a basic understanding of personal finance. Only after that foundation has been set do I introduce the concept of investing. My goal is that by the end of this book, your children will understand three main ideas: The concept of saving money versus spending money - The importance of making a budget to track income and expenses - The principle of compounding and how investing your money can make you MORE money over time Your children may not be quite old enough yet to start working a job to earn money or to invest in the stock market, but the earlier they begin to understand the importance of these things, the more likely they are to take them seriously once they can. Lastly, I want to point out that throughout this book, your child will follow the story of Thrifty Tortoise and Ritzy Rabbit as they reenact Aesop's classic fable, "The Tortoise and the Hare," with a twist toward money management. In each chapter, the characters make different money decisions that bring them closer to—or set them further away from—the ultimate goal of getting enough money to purchase a new bike. In this story, "crossing the finish line" is an analogy for making money management decisions that will allow your child to achieve life goals. Personal finance, and particularly investing, is a long-distance race. It is an ultramarathon. The story line in this book may only last seven chapters, but the real journey will last a lifetime. Sincerely, Luke Villermin Luke Villermin opened a retirement account and started investing in the stock market at fifteen years old. His only regret...he didn't start earlier. Since then, he has become the best-selling author of the Invest Now Play Later series and has shared his investing knowledge on multiple podcasts and interviews. When he isn't working his corporate day job or advocating financial literacy for young people, you can find him hiking, camping, and traveling to new places. Visit his website at lukevillermin.com. He loves to hear from readers.