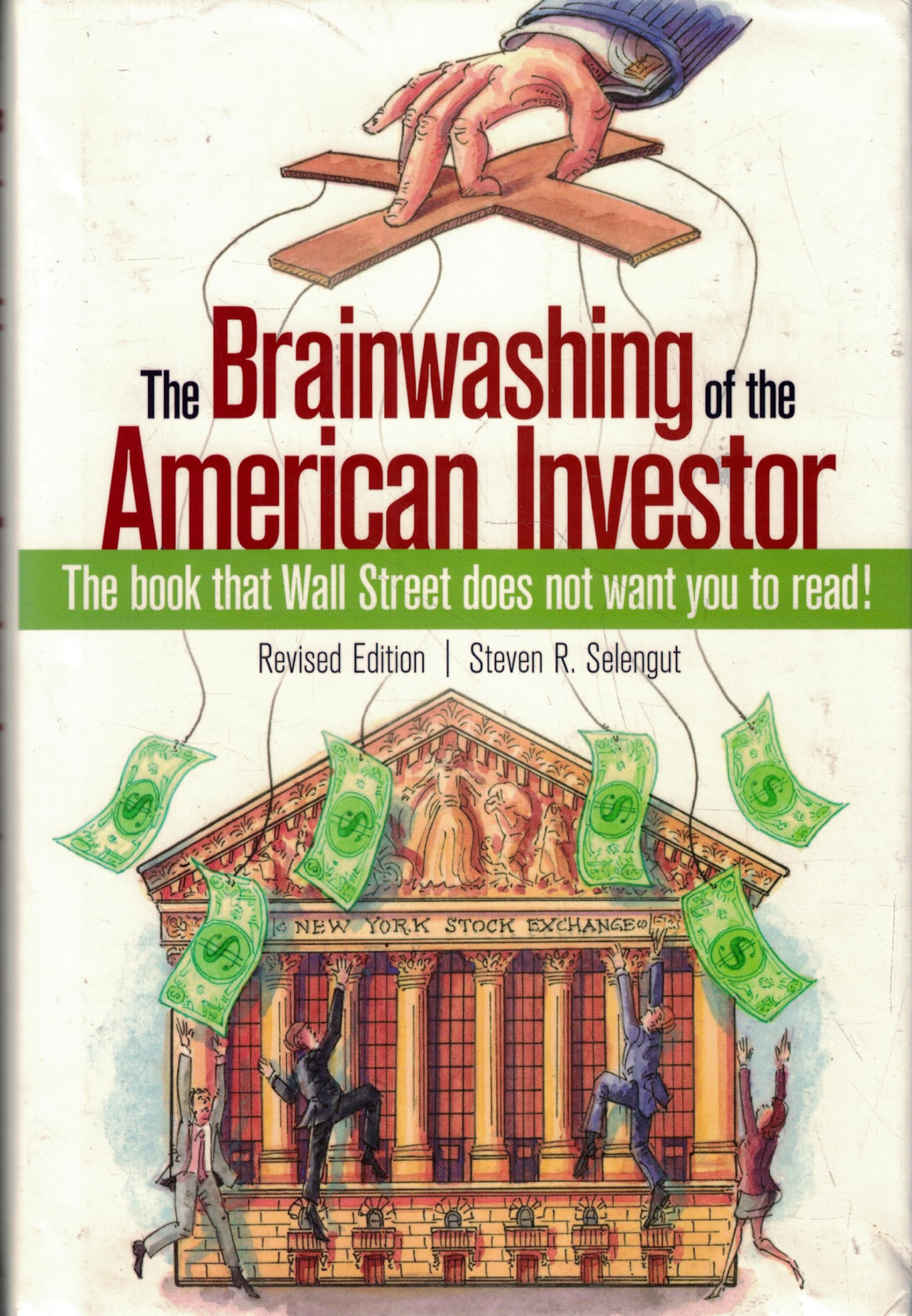

The Brainwashing of the American Investor: The Book That Wall Street Does Not Want You to Read!

$20.59

by Steven R. Selengut

Shop Now

The Brainwashing of the American Investor is a hands-on, practical investing manual that challenges the prevailing wisdom to put your trust blindly in Wall Street. Author Steven Selegut explains how The Street s investment trend of-the-moment may actually be more for the investment house s benefit than your own. There is no one-size-fits-all winning formula to make money on Wall Street. Selengut has spent more than thirty years in the investment world developing his tried-and-true working capital model that you can modify for your own financial circumstances. Selengut tells you why you need to think outside the Wall Street box to develop your personal asset allocation plan. Contrary to popular belief, investing is not a competitive event; it is an individual and goal-directed activity. Mutual funds the most common investment vehicle for most Americans are not the best way to grow your nest egg over the long term. Selengut s unconventional but common-sense strategies will help you make the most of your investment dollar. The working capital model outlines a sensible, realistic, and safe strategy for long-term, profitable investing. Master concepts such as: How to develop the asset allocation plan that is right for you. How to identify quality investments. Why income is the only real hedge against inflation. Why mutual funds are not the best way to diversify your investments. Why corrections are every bit as lovable as rallies. How to diversify properly. How to establish the all-important profit-taking sell target and when to take profits. Why commissions and taxes are secondary investment considerations at best. How to monitor investment performance without thinking about market numbers or anything else that is outside of your personal goals and objectives. Why the market value of your equity holdings and that of your income investments are completely unrelated. Why the income generated by your assets is more important than their current market value. Steven R. Selengut, MBA, RIA, has been in the financial services industry for more than forty years. He started investing while employed in a life insurer's pension investment department. At age 25, he gained responsibility for a modest trust portfolio and began his trading career using the working capital model outlined in this book. Selengut's twelve-year adventure in financial services produced an appreciation for the Wall Street environment that helped him fine tune his unique investment strategy. The program's success propelled him into early retirement at age 33 and a new career as a private investment portfolio manager. He developed a unique cost-based approach, with individually managed investment portfolios, low annual fees, and commissions to an uninterested third party. He has built a loyal following of dedicated clients, many of whom have been with him since the beginning. More information about his investment management business can be found by calling (800) 245-0494. Selengut, a native New Jerseyan, lives near Charleston, South Carolina, with his wife and best friend of fifty years, Sandra. They have two grown children and two growing grandchildren. Used Book in Good Condition