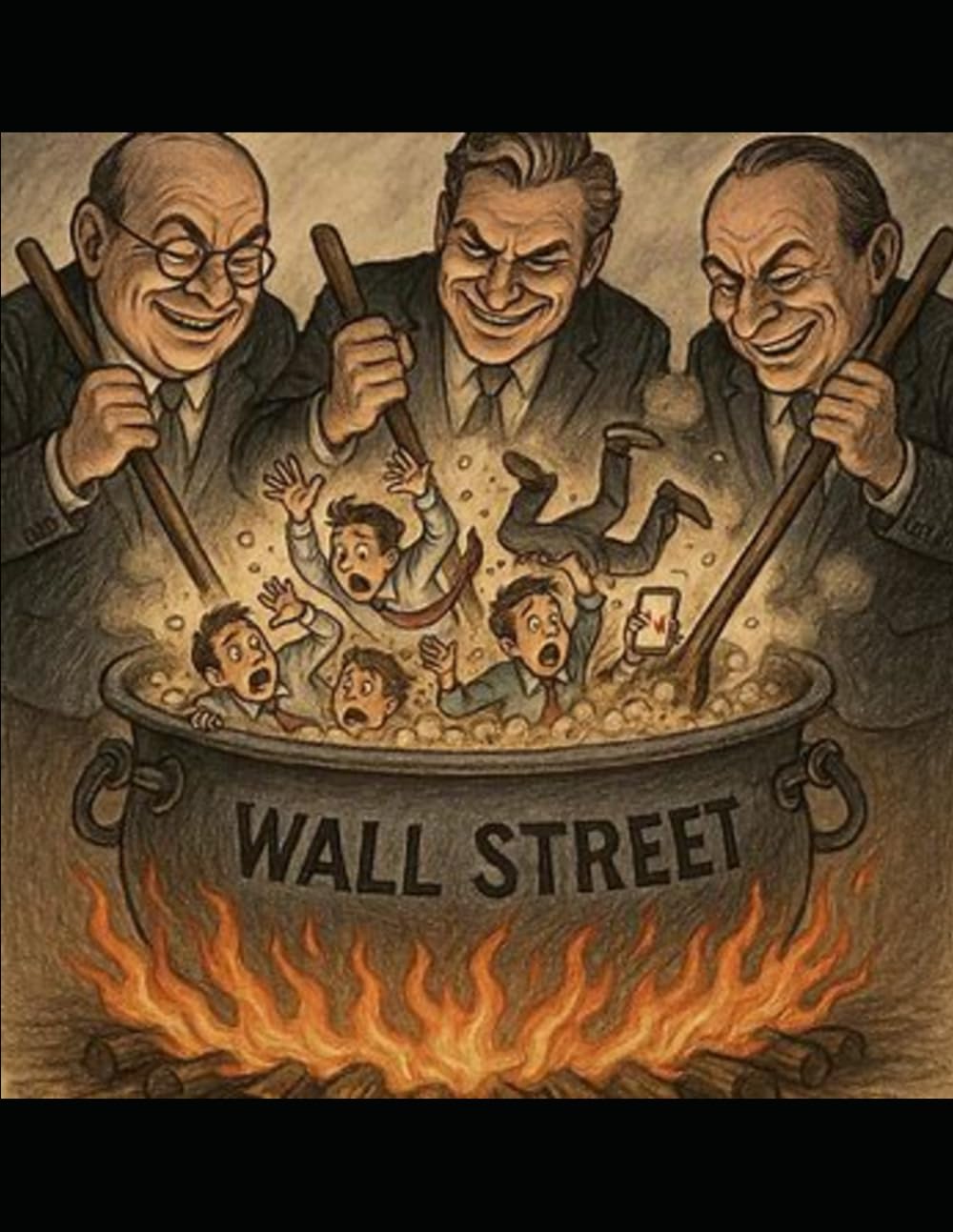

“GAP-TRAP”: The Hidden War Between Market Makers And Retail Traders

$12.99

by James Daniels

Shop Now

The markets aren’t fair — but they are predictable. In GAP-TRAP™ , bestselling author and market analyst James Daniels pulls back the curtain on one of Wall Street’s most effective weapons against everyday investors: the engineered false breakout. This groundbreaking exposé reveals how market makers manufacture excitement, trigger emotional reactions, and use volume and volatility to drain retail traders of their capital — all while appearing to “create liquidity.” With clear examples, real chart breakdowns, and insider-level insight, Daniels introduces readers to the GAP-TRAP™ — a pattern he identified to describe how news-driven gaps at the open lure traders into buying the high or shorting the low, only for the market to reverse violently intraday. What looks like opportunity is often orchestration — a liquidity event disguised as momentum. You’ll learn: How market makers and algorithms engineer false breakouts using volume, VWAP, and timing. - Why retail traders fall victim to herd behavior and psychological conditioning . - The difference between legitimate liquidity and predatory traps. - How to read price/volume behavior to confirm or reject a breakout before entering. - Step-by-step tactics to exit with institutions, not after them. - How to recognize GAP-TRAP™ setups in real time and turn manipulation into opportunity. Through a blend of research, strategy, and unflinching realism, GAP-TRAP™ exposes how the financial elite weaponize emotion — and how you can fight back with data, patience, and precision. Whether you’re a day trader, swing trader, or long-term investor, this book will teach you to stop being the target… and start trading like the trap setter.